Connecticut has an innovative program that invests $3,200 on behalf of each baby born into poverty in the state (as determined by Medicaid eligibility). Between the ages of 18 and 30, the child can claim those funds and any investment proceeds—forecast to appreciate to $11,000 to $24,000—to buy a home, pay for higher education or job training, start a business, or save for retirement. The approach, known as “baby bonds,” aims to combat the inequality that leads to dramatically different opportunities for kids based on the finances—and relatedly, race and ethnicity—of the families they’re born into.

What if employers did the same thing for the babies of their workers, especially the lowest-paid employees?

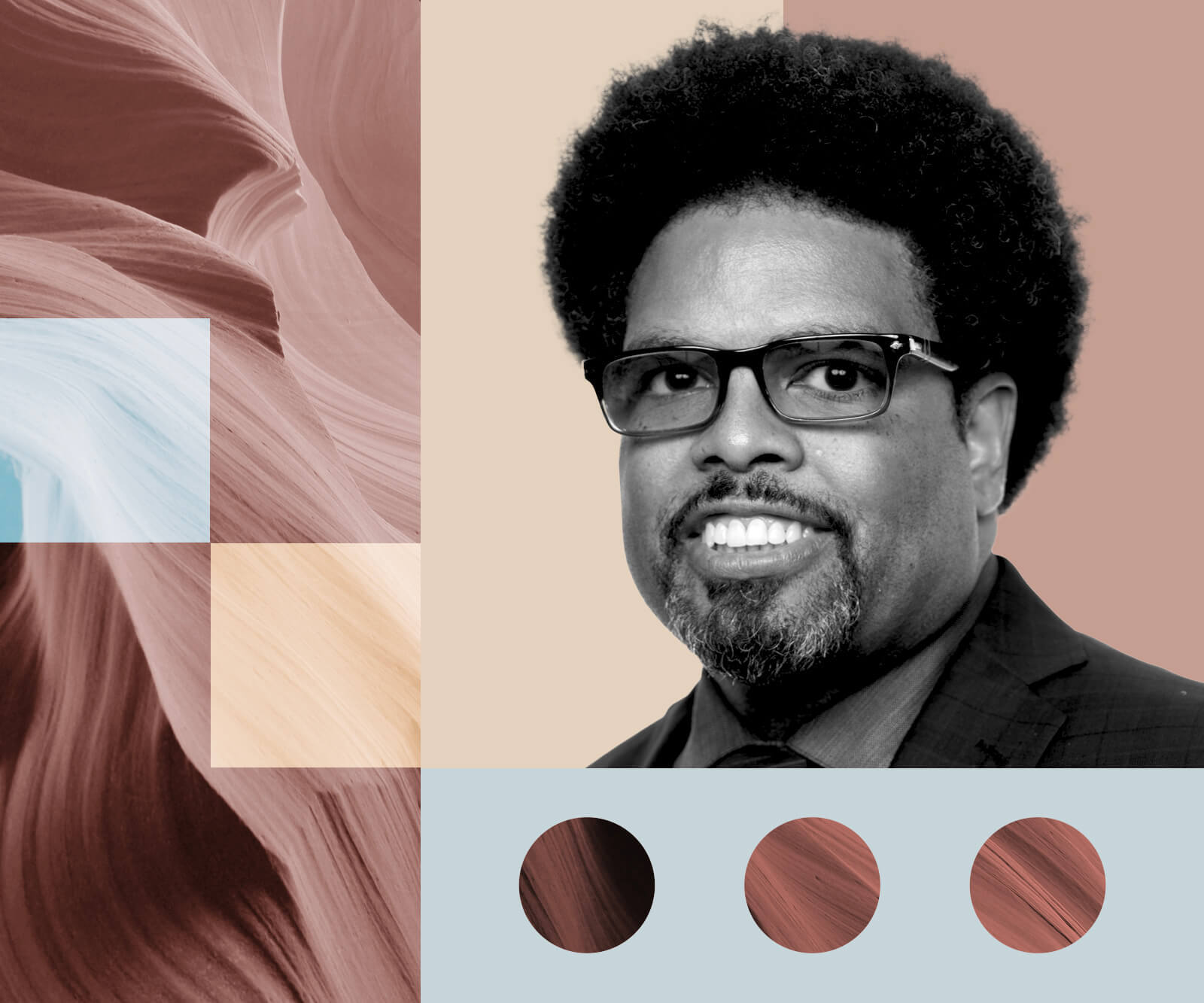

We’re not aware of any companies doing this yet (please email us if you are). But we think it’s an idea worth exploring, and spoke with Darrick Hamilton, a primary originator and champion of the baby bond approach and professor at the New School for Social Research. Here are excerpts from our recent conversation, edited for space and clarity:

The way that baby bonds today are administered is generally through a government program. Should an employer consider setting up their own baby bond program?

First and foremost, this needs to be done through the public sector to avoid things like job locks and to ensure that it’s universal and not simply tied to work. That said, similar to how state governments are taking initiatives before they get to the federal government, one could imagine employers who are interested in providing better workplace scenarios very well may invest in their employees, perhaps in a more universal, better way than we currently do by reserving for a certain class of workers stock options.

Why not develop the asset capacities of all their workers through baby bond-like programs to provide lower-wage workers the ability to have matched down payments or reserve down payments for a home? To provide lower-wage workers a capital foundation for their children to be able to get into entrepreneurial activity? To provide lower-wage workers access to an education without debt? What I’m trying to get at is to juxtapose what they currently do in terms of stock options and other reserved employee benefits for their managerial and professional classes, and extend it to their working labor classes as well in ways to promote asset development for them.

If I were an employer looking to do this, is there anything standing in my way? What is the level of investment that this would require?

I always give this metaphor: The difference between a renter and a homeowner is often a down payment. The program needs to be devised in such a way that there’s enough resource to capture the down payment.

A caveat that we have to be leery of is if there’s overreach and we end up in a dystopia-like scenario where corporations are invested in employee livelihood in a controlling way that is detrimental to the employees’ agency. We have historical examples of corporations with vulnerable workers where they have control, so this needs to be done in a fair way.

We occupationally stratify our workplace in a way that certain classes of workers get certain benefits, but not all. Baby bonds present a scenario to empower the second-tier workers.

What’s meaningful to provide people in terms of the amount of baby bond available upon maturity?

You want to think about the median, or perhaps 40th percentile, of housing in an area. What would be the necessary down payment to get that child into it?

Read a transcript of our conversation with Hamilton, which includes discussion of parallels to the US GI Bill and university faculty housing, as well as what employers could learn from the Connecticut baby bonds program.