Our evaluations and opinions are not influenced by our advertising relationships, but we may earn a commission from our partners’ links. This content is created independently from TIME’s editorial staff. Learn more about it.

By all accounts, 2023 was a prosperous year for investors. The S&P 500 posted a gain of 24.33% for the year. But that performance followed a tumultuous 2022, in which the market lost 19.44%. If you balance out the two years, you’d have about broken even. Will 2024 see a continuation of the gains of 2023, or will uncertainty return us to the bear market experienced in 2022?

Whatever 2024 holds, the combination of a big loss in 2022 followed by an even more impressive upturn in 2023 confirms maintaining focus on the long-term. That’s why despite lingering uncertainties about the financial markets, interest rates, the economy, and geopolitical concerns, we’re going to focus on the best long-term investments for 2024.

YieldStreet

YieldStreet

What to invest in right now for the long term

There are dozens of potential investments for you to hold in your portfolio. But it’s more important to select a small number likely to produce the best returns.

1. Exchange Traded Funds (ETFs)

ETFs have grown to become one of the most popular investments. Not only does each one enable you to invest in a diversified portfolio of securities, but funds are available that cover hundreds of different asset classes.

Unlike mutual funds, ETFs can be traded just like stocks and purchased for the price of a single share or less. That makes it easy to diversify your portfolio with even a small amount of money. J.P. Morgan Self-Directed Investing Platform can give you the tools to help you evaluate the best choices.

J.P. Morgan Self Directed Investing

J.P. Morgan Self Directed Investing

“I would suggest that people with a long-term time horizon invest in diversified, low-fee index funds,” recommends Robert R. Johnson, Ph.D., CFA, CAIA, Professor of Finance, Heider College of Business, Creighton University. “From 1926 through 2022, according to Ibbotson Associates, the compound annual rate of return of a diversified portfolio of large stocks (the S&P 500) was 10.3%.”

That’s an example of the returns in the general stock market. Specific sectors can have even higher yields.

“Investing in a diversified basket of small stocks provides even greater returns,” continues Johnson. “The compound annual rate of return of a basket of small stocks over those 97 years according to Ibbotson Associates was 11.8%.”

Some ETFs specialize in growth stocks, dividend stocks, value stocks, international stocks, and sector funds, like technology and healthcare. You can simply choose which asset classes you want to hold in your portfolio.

“The future is too uncertain for a single security or asset class,” adds Robert Michaud, Chief Investment Officer of New Frontier Advisors. “The best long-term investment is a diversified portfolio of stock and bond ETFs optimized for your long-term goals. If that’s not available, pair a global stock ETF with an aggregate bond ETF to manage risk.”

2. Dividend Stocks

Dividend stocks are among the best stocks to buy now. A big reason is they have a history of weathering stormy markets better than other stocks, like growth stocks.

"Given the current macroeconomic and geopolitical uncertainty, dividend-paying blue chip stocks remain the preferred choice for this year," advises Sam Boughedda, equities trader and lead stock market news writer at AskTraders.com. “They provide investors with a potential return on their investment in an unstable market. Well-known, high-quality companies provide some stability in the current unstable environment, with companies such as Apple, Mastercard, Visa, and Walmart being some of the better choices, in our opinion.”

You can do this by investing in a class of dividend stocks known as the Dividend Aristocrats. This is a group of more than 60 companies that are part of the S&P 500 and have produced at least 25 consecutive years of dividend increases.

The website Sure Dividend provides an updated list of these stocks each year. You can choose to invest in the companies you like or invest in the entire group through an ETF. The ProShares S&P 500 Dividend Aristocrats ETF (NOBL) is a popular example.

M1 Finance offers an all-encompassing investment solution, comprising a user-friendly mobile app and a desktop platform, aimed at demystifying and facilitating investing for individuals of all expertise levels. This empowers you to select your preferred dividend stocks with confidence. Additionally, M1 Finance provides automatic dividend reinvestment, ensuring your investments remain fully engaged at all times.

M1 Finance

M1 Finance

Up to $500 when signing up and earn up to $10,000 when transferring your brokerage account to M1 Finance by by November 15, 2023. T&C apply.

3. Short-term Bonds

Historically, long-term bonds have provided higher interest than short-term bonds. But that’s not the case in 2024 and hasn’t been for the past couple of years.

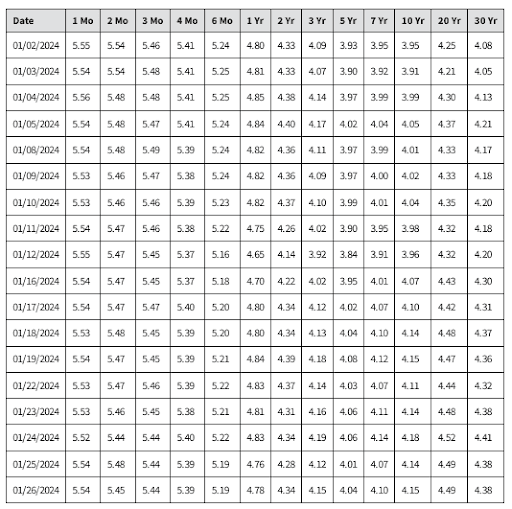

The table below shows the yield on US Treasury securities for the month of January, through the 26th.

Notice that the latest return on a one-year Treasury note (4.78) is slightly higher than that of the 30-year Treasury bond, at 4.38%. The range on all shorter-term securities, ranging from one month to one year, is higher than the yield on both the 30-year bond and the 10-year note.

This is what is known as an inverted yield curve. It’s not a common situation, but it is the current order of the day. And it favors investing in short-term bonds over the long-term variety.

“The yield curve provides some clues regarding market expectations,” says John Cunnison, CFA and VP/chief investment officer at Baker Boyer National Bank. “Currently, the yield is inverted, which means that you can receive a higher yield in shorter bonds with less interest rate risk. While this may seem like a great deal, it comes with significant opportunity costs. If the Fed reduces the Fed Funds Rate sometime this year and into next year, which they have indicated is a distinct possibility, the attractive short-term rates investors have been enjoying could fall as fast as they went up.

“By investing in slightly longer bonds, investors can protect against the possibility of falling rates. In a falling rate environment, the yield on longer bonds will look increasingly attractive and the price of longer bonds will increase more than that of shorter bonds. There’s nothing wrong with having more in a money market than normal, just don’t overdo it.”

Public App

Public App

Fees:

4. Real Estate

Real estate is always competing with the stock market as the best long-term investment vehicle. In 2024, that competition shows no signs of changing anytime soon.

You can invest in individual properties, but that does require both a large amount of capital and hands-on management.

A much simpler way, and one that fits better within a portfolio, is to invest through real estate crowdfunding platforms.

“Historically, real estate has always been the best-performing asset class,” notes Patrick Donoghue, Vice President, Market Risk at Groundfloor Finance. “One of the best ways to invest is through private capital real estate deals. We’ve seen consistent 10% annualized returns across our portfolio. With fractional real estate investing, you can invest $10,000 at $100 each into 100 different projects and be well-diversified.”

Real estate crowdfunding platforms are a way to invest in property while getting the benefit of professional property management.

A similar way is to invest in real estate investment trusts or REITs. These are funds that invest primarily in commercial real estate. That can include office buildings, retail space, large apartment complexes, and similar properties. For 2023, REITs provided a return of 11.7%. While that's well below the performance of the S&P 500 for the year, it's sufficient to justify REITs as a worthy portfolio addition for diversification purposes.

REITs trade like stocks and generally offer high dividend yields, as well as the potential for capital appreciation. It’s also an opportunity to invest in a portfolio of properties, which offers greater diversification than purchasing a single piece of real estate.

One of the best options in today's market is RealtyMogul. RealtyMogul is a crowdfunding platform for buying and selling commercial real estate. The platform is good for accredited and nonaccredited investors alike.

RealtyMogul

RealtyMogul

5. Alternative Assets

This category of investment assets has been growing in recent years. As it has, more opportunities have arisen for small investors to participate.

In general, alternative assets take in investments beyond stocks, real estate, funds, bonds, and other fixed-income assets. It can include private equity, fractional ownership of real property, precious metals, cryptocurrencies, and other assets.

“Our thesis is that the historical 60/40 equity/bond allocation is no longer a viable strategy,” advises Milind Mehere, founder & chief executive officer at Yieldstreet. “Increased correlations across assets and sectors lead to boom/bust outcomes. We recommend enhanced diversification through alternative investments, which provide reduced correlation and increased return potential in a modern portfolio of, say 40/30/30 equities, bonds, and alternatives, respectively. This modern portfolio is more accessible to investors than ever, including the ability to invest in alternative asset classes (such as real estate, private credit, and private equity) within tax-advantaged accounts.”

If you do invest in alternatives, you should limit your position in any single asset class. Though alternatives have significant profit potential, they carry commensurately greater risk. For example, if you want to invest 10% of your portfolio in alternatives, you may want to split the allocation among five or more asset classes.

“Diversification through alternatives will continue to offer protection from market volatility this year. Incorporating an allocation to alternatives is not only key to mitigating overall risk but may offer elevated opportunities,” agrees Travis Forman, portfolio manager at Strategic Private Wealth Counsel, Harbourfront Wealth Management. “As the market anticipates a rate cut in the second half of the year, investors may be able to capitalize on an upward trajectory, particularly in areas like private real estate. In the event inflation persists at elevated levels, private credit may offer enhanced yields as an attractive investment avenue.”

YieldStreet

YieldStreet

How to best invest for the long term

Investing is partially about choosing the right investments, but also about implementing the right strategies.

The following tips should help you be a better investor over the long term.

Plan to be in for the long term

Investing is much like building a business, in that it requires a long-term commitment. That will mean disregarding short-term dips in favor of a committed long-term outlook.

You should plan to be a regular investor, committing fresh capital even when the market is down. History has shown again and again that the markets eventually recover. But you’ll only be able to take advantage of the next surge if you’re in the market even when the outlook seems uncertain.

Know your risk tolerance

At its core, risk tolerance is your emotional ability to live with the risk of a declining market. Before you even begin investing, you should start by determining your risk tolerance.

Risk tolerance levels range between conservative and very aggressive, with several iterations in between. Knowing where you fall on the risk tolerance spectrum will be critical in developing a portfolio you’ll be comfortable with.

For example, if you’re more conservative, you should slant your portfolio in favor of bonds and dividend stocks. But if you’re more aggressive, you should favor growth stocks.

Vanguard offers a free Investor Questionnaire to help you determine your risk tolerance. Based on the answers you provide Vanguard will recommend one of nine asset allocations. You can then build your portfolio based on those allocations with the investment broker of your choice.

Diversify

When dividend reinvestment is included, S&P increased by 26.44% in 2024, adding more than 2% to the market return for the year. No matter how optimistic you may be going forward, another decline in 2023 can’t be ruled out. Dividends are one of the best protections against volatility in the stock market.

That’s why it’s important to be diversified, and that means investing beyond stocks alone. Even if the stock market continues to rise rapidly in the coming months, maintain adequate positions in both fixed-income investments and cash.

Not only will those positions minimize the impact of unexpected market declines, but they’ll also provide you with liquidity to take advantage of stocks at lower prices.

Keep contributing to your investment accounts

Investing is a strategy, not an event. You should have a plan in place to make regular contributions to your investment accounts. Contributions plus investment gains are the closest things to a secret sauce when it comes to investing. It gives you the benefit of growth coming from two different directions.

This is easy to do if you participate in an employer-sponsored retirement plan. Regular contributions into a 401(k) or equivalent program are easy and automatic.

But you can do the same thing with a traditional or Roth IRA, or even a taxable investment account, by setting up regular direct deposits from your paycheck.

One of the unexpected benefits of making regular contributions is taking advantage of dollar-cost averaging. Because your contributions will be a fixed amount, you’ll automatically buy more shares at lower prices and fewer shares at higher prices.

Fees matter!

If funds make up most of your portfolio, you’ll need to be aware of the fees involved. That will apply to either ETFs or mutual funds. Those fees can range from near zero to 1% or more per year. These aren’t just a cost of investing, but they also reduce your investment earnings.

If you invest in a fund with an average annual return of 7% and an expense ratio of 0.75%, your net annual return will be 6.25%. Over 20 years, a $10,000 investment will grow to $33,618.

If instead, you invest in a similar fund, also with an average annual return of 7% but with an expense ratio of 0.25%, your net annual return will be 6.75%. Over 20 years, the $10,000 investment will grow to $36,928.

The difference of $3,310 will represent the higher cost of the fund with the high-expense ratio.

By choosing a fund with a low expense ratio, you’ll win by default.

To get an accurate understanding of fund fees take advantage of the Fund Analyzer tool provided by FINRA. It provides analysis of more than 30,000 funds, helping you to choose those with lower fees.

Hire a financial advisor

If you want to invest and you have the cash to do it, but you’re not confident in your ability to manage your portfolio, consider hiring a financial advisor.

A good financial advisor will evaluate your risk tolerance, future goals, time horizon, and other obligations. That information will be used to create a portfolio that will best suit your unique investment style and preferences. Meanwhile, the advisor will provide ongoing management so you’ll be free to tend to everything else in your life.

If you’re not sure where to begin your search, WiserAdvisor provides an online database of financial advisors from both Fortune 500 companies and small independent firms. All advisors are subject to a qualification process to be eligible for inclusion in the network. You can also check out SmartAdvisor from SmartAsset. They provide a financial advisor matching tool webpage to help you find the right advisor for your needs and preferences.

Find the right financial advisor with WiserAdvisor

Find the right financial advisor with WiserAdvisor

Alternatively, you can invest through robo-advisors. These are online, automated investment platforms that provide complete portfolio management at a very low annual fee. They’re perfect for smaller investors who lack the minimum portfolio size – sometimes $500,000 or higher – traditional financial advisors require.

Long-term investing is a long game

You don’t need to be a financial wizard to be a successful investor. But you do need to know the best long-term investments and have general strategies to manage them effectively.

Choose some of the investments and follow some of the strategies in this article. But if you don’t feel comfortable doing this on your own, don’t hesitate to engage the services of a good financial advisor.

Nothing less than your future financial success hangs in the balance. No matter what your investing history may be, you have an opportunity to increase the odds in your favor by making the right choices now.

**INVESTMENT AND INSURANCE PRODUCTS ARE: NOT A DEPOSIT • NOT FDIC INSURED • NO BANK GUARANTEE • MAY LOSE VALUE**

The information presented here is created independently from the TIME editorial staff. To learn more, see our About page.